vermont department of taxes myvtax

Our tax examiners are available Monday through Friday from 745 am. Your Vermont withholding account number should start with WHT and either a 10 or a 11.

Please contact the Vermont Department of Taxes Taxpayer Services Division at 802 828-6802 or myVTaxSupportvermontgov.

. 745 AM - 430 PM. 3 were not claimed as a dependent by another taxpayer for tax year 2021. How do I sign up for myVTax.

You may now close this window. Understand and comply with their state tax obligations. Modernized e-File Users MeF.

Click the Sign Up hyperlink in the Sign in panel on the myVTax Home Page. PA-1 Special Power of Attorney. IN-111 Vermont Income Tax Return.

Vermont School District Codes. Skip to Main Content. For help with myVTax please see our frequently asked questions for more information.

Personal income tax and fiduciary tax cannot be filed through myVTax and must be filed through MeF vendor software. Department of Taxes Use myVTax the departments online portal to electronically pay your Estimated Income Tax. MyVTax is available for corporate and business taxpayers to file their income taxes employer withholding tax sales and use tax meals and rooms tax and other business tax types.

Vermont Department of Taxes ACH Credit Processing 133 State Street Montpelier VT 05633-1401 The following instructions provide information for taxpayers wishing to submit an ACH Credit payment to the Vermont Department of Taxes VDT for the following tax types. You may now close this window. Click the SIGN UP hyperlink in the sign in panel on the myVTax Home Page.

W-4VT Employees Withholding Allowance Certificate. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal. Send us a message in the form below.

3 were not claimed as a dependent by another taxpayer for tax year 2019. How do I sign up for myVTax. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

What you can do in myVTax. Vermont Department of Taxes Issues Refunds to Unemployment Benefit Recipients May 10 2021 May 17 Vermont Personal Income Tax and Homestead Declaration Due Date. Homeowners eligible for a credit are those who 1 owned the property as a principal home on April 1.

If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. If you file through MeF you may continue to do so even if the tax type can be filed through myVTax. VTax ACH Credit Payment Options Tax Type Taxpayer ID Preˇx Tax Type Code.

Vermont Department of Taxes. The system is located at the vermont department of taxes 133 state street montpelier by appointment only on mondays and wednesdays. Vermont department of taxes myvtax online portal.

2 were Vermont residents all of calendar year 2021. Locate a Vital Record Search and request certificates of birth. As each tax type is added to VTax over the four-year conversion taxpayers will be able to do the following.

Get Help with myVTax. Taxpayers may grant access to third-party advisors through myVTax. We are here to answer any questions you have about myVTax.

Mandate to File Using myVTax It has been mandated that taxpayers must use myVTax to file returns for the following tax types. Please contact the Vermont Department of Taxes Taxpayer Services Division at 802 828-6802 or myVTaxSupportvermontgov. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont.

Fields marked with an asterisk are required. What you can do in myVTax. Sales and Use Tax for multiple locations.

Sign Up for myVTax. You should receive your account number in 5-7 days. Here is a sneak peek at the new myvtax home page.

Complete the remaining questionsfields. Vermont department of taxes myvtax online portal. Vermont department of taxes myvtax.

If your email address has changed since the time you first registered or you experience any other problem with your password or username please contact the Taxpayer Services Division or by completing the form below. MyVTax - Logged Off. If you have any questions about the process call the agency directly at 802 828-6802 or send an email to taxbusinessvermontgov.

Taxes for Individuals File and pay taxes online and find required forms. The Vermont Department of Taxes reminds Vermont taxpayers that the due date for federal and Vermont personal income tax is April 18 2022. The property tax credit assists Vermont residents to pay property tax and is based on a percentage of household income.

Click the Sign Up hyperlink in. DEPARTMENT OF TAXES Filing a Landlord Certificate online can save labor and time. Voter Services Register to vote and find other useful information.

File and Pay Your Taxes Vermontgov Freedom and Unity. Please provide a daytime number where you can be. Please contact the Vermont Department of Taxes Taxpayer Services Division at 802 828-6802 or myVTaxSupportvermontgov.

The two prior years of sales will be available at that time for validation. Christie Wright Field Director Property Valuation and Review Division Vermont Department of Taxes Cell 802 855-3897 133 State Street Montpelier VT 05633-1401 taxvermontgov This email may contain confidential tax information. You have been successfully logged out.

The system is located at the vermont department of taxes 133 state street montpelier by appointment only on mondays and wednesdays. Department of Taxes httpsmyvtaxvermontgov_ No Support. Click Here to Start Over.

MyVTax the Taxpayer Access Portal myVTax is the secure online filing service for Vermont taxpayers. Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes.

Vermont Department Of Taxes Facebook

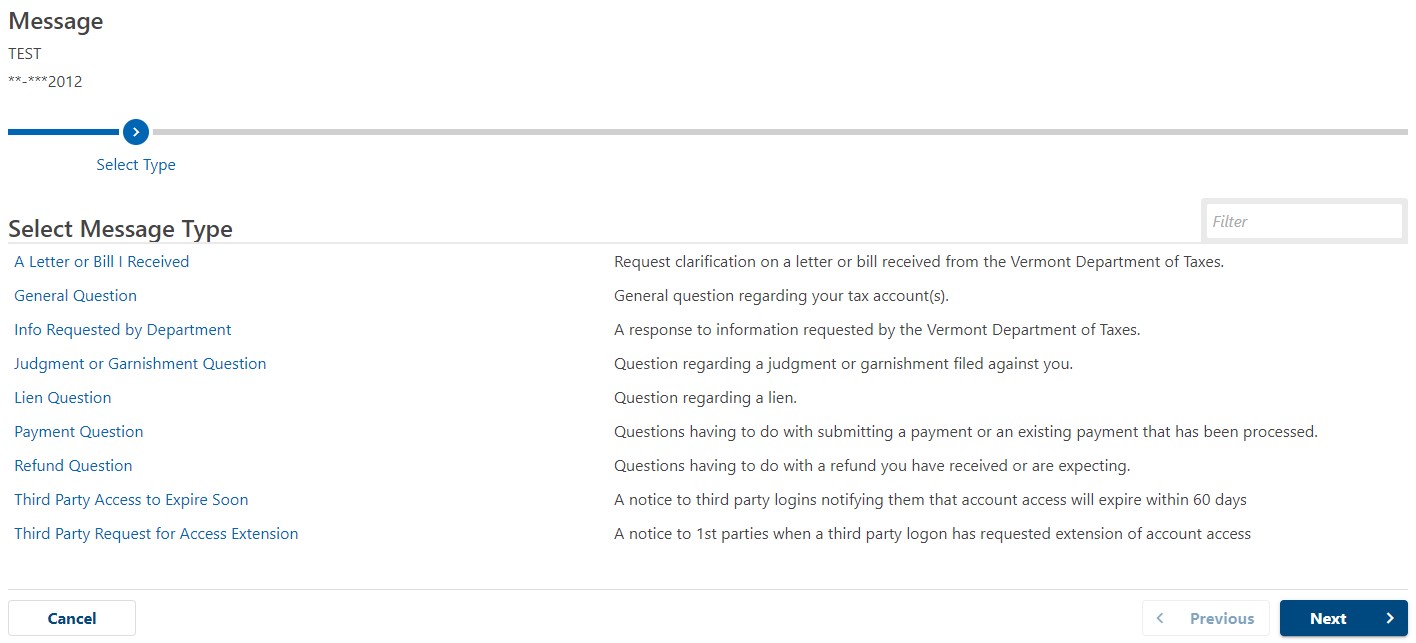

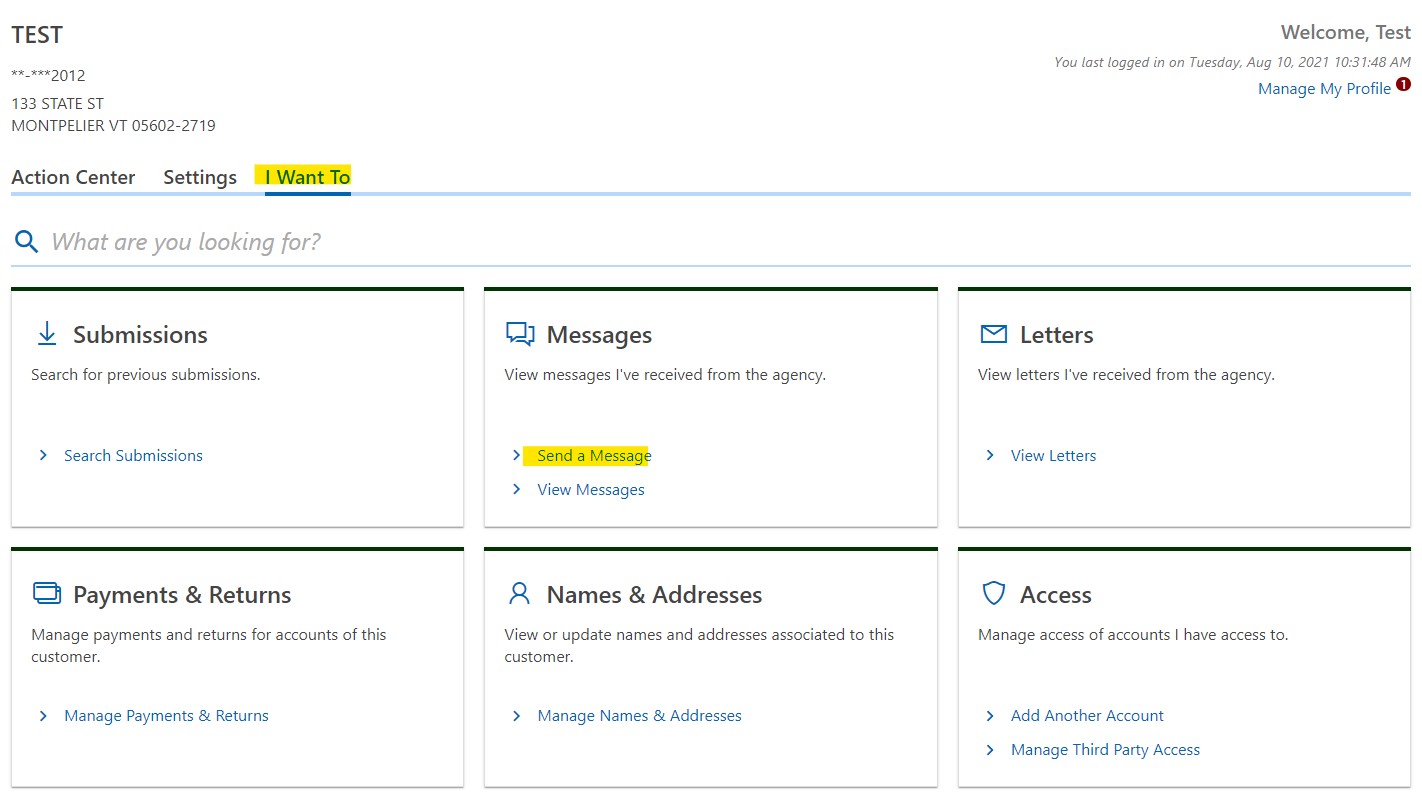

How To Send A Secure Message Department Of Taxes

Vermont Department Of Taxes Facebook

File A New Vermont W 4vt Department Of Taxes

On Demand Webinars And Training Materials Department Of Taxes

Publications Department Of Taxes

Vermont Department Of Taxes New To Business Using Myvtax To File Your Business Taxes Electronically Is Way Faster Than Paper And Is Required In Most Cases How To Get Started See

Filing Season Updates Department Of Taxes

How To Send A Secure Message Department Of Taxes

Vermont Department Of Taxes Renter Rebates And Refunds Are Processed Separately And May Arrive At Different Times Here S More About The Renter Rebate Including How To Claim It Https Tax Vermont Gov Individuals Renter Rebate Facebook

Rp 1231 Vermont Department Of Taxes Organizational Chart Department Of Taxes